However, as technology advanced, information on all subjects became decentralized. This made it possible for anyone to access knowledge on concepts like investments, and this is where Mobic Edge comes in.

Mobic Edge is a bridge utilizing this technological advancement to connect interested individuals with investment education firms. Mobic Edge has a user-friendly site that makes it easy to get started with a suitable education. Anyone can start for free on Mobic Edge.

Save the time and effort needed to find a suitable tutor. Avoid being overwhelmed by all the investment information out there. Mobic Edge is here to give people access to suitable investment education firms. Registration is free.

Learn about investments in any language. Mobic Edge is a global solution, and we understand the diversity of languages.

With the Mobic Edge site, users don't have to worry about language differences. We have provisions to make sure no one is hindered from finding an investment tutor.

That’s right. No fees, no charges. Mobic Edge brings investment tutors right to the average person for free. The Mobic Edge website is easy to use.

We’re all about making it easy to learn to invest. Register on Mobic Edge for free. Embark on a journey of learning and discovery in the investment world.

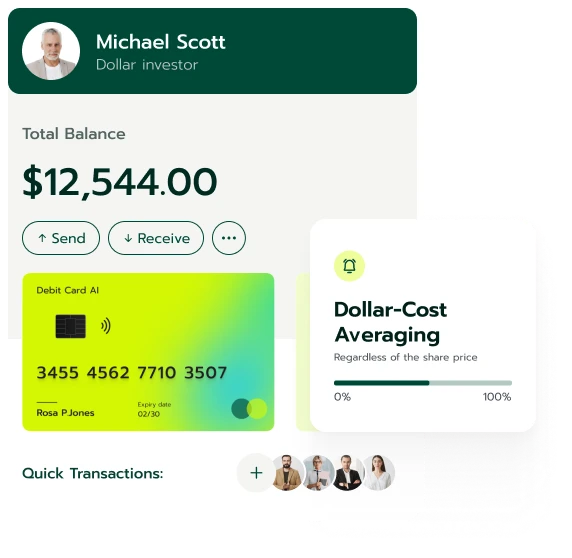

Sign up by providing a name, email address, and phone number. Immediately after, access is granted to an investment education firm. Irrespective of language differences, we're here to help. Connect with a suitable tutor at no cost with Mobic Edge.

Mobic Edge bridges the gap between individuals interested in investment education and investment training firms. How do we do this? We connect our users to suitable investment education firms. What is great about using Mobic Edge is that it’s completely free.

After registration, users will be contacted by their assigned education firm for onboarding. They’ll be asked about their experience and interests. The rep will craft a personalized curriculum for their learning. This ensures that users learn what’s relevant to their goals.

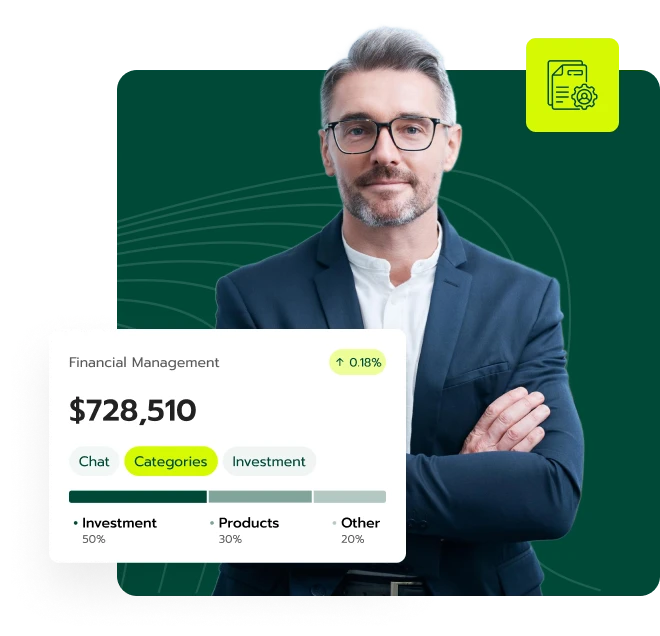

Mobic Edge helps people get an objective perspective on these things. How do we do this? Mobic Edge achieves this by linking individuals to suitable investment education firms. There, they are trained to make informed financial decisions. Learn all there is about investments via Mobic Edge.

Value investors buy stocks that appear to be undervalued, given a detailed analysis of their standing. This strategy is based on the belief that the stock market sometimes undervalues it in the short term, but the “true” worth may be realized over time.

Learn more about value investing via Mobic Edge after signing up. Steps involved in value investing include:

The first thing value investors look for is undervalued stocks. They may apply certain parameters to find them, such as stocks with a low P:E ratio. The same criterion may be used to search financial databases to locate companies that satisfy the condition.

Investors then study the company's income, cash flow analysis, balance sheet, and cash flow statement. This is to determine if the stocks are worth buying.

Determination of intrinsic value

Investors may use different valuation methods, such as discounted cash flow rate analysis, to calculate a company's worth based on its future cash flow.

Buying the stocks

After determining the intrinsic value, investors then go ahead and buy the stocks if they are still at a price lower than their “true” price. They then may continue to monitor the performance of the company. Learn more via Mobic Edge.

Hold

The investors may wait several years until the market agrees with them. This approach involves patience and long-term orientation. This is because investors must avoid getting carried away by short-term market signals and stick with the company's fundamentals instead.

By holding the stock, investors may allow the company to implement its business model and provide proof of its worth. If the company is doing well, the market may eventually react positively to the stock, and its value could be appreciated.

They will run their checks on the investment to ensure that the company still holds the value criteria for investors. This lasts until the investment is ripe for sale. Register on Mobic Edge for free. Get connected via Mobic Edge for more education on this concept.

This is then followed by the evaluation of the risk that one is willing to take to go after said goal. After that, risk diversification across different portfolios, including real estate, bonds, and stocks, will be managed. It may also include periodically revisiting and updating the plan to reflect new financial objectives, market trends, and individual situation changes.

Investment planning may enable individuals to meet long-term objectives and facilitate financial goals through risk management. To get connected to firms that teach investment planning, sign up on Mobic Edge for free.

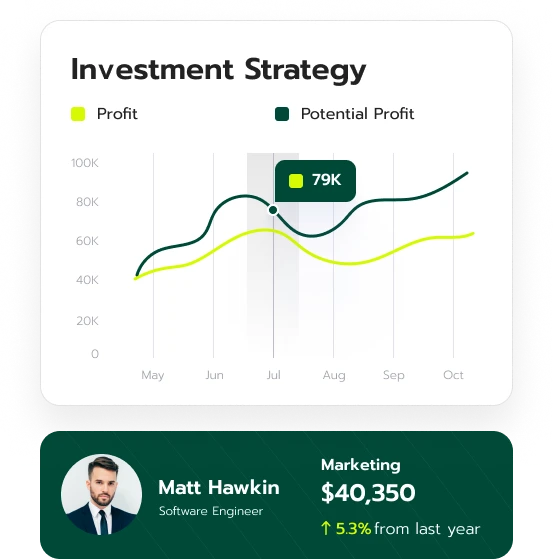

These are methods adopted by investors to allocate capital in various securities. These strategies act more like a map for the investor. They come into play, especially when deciding which assets to invest in, the amount to invest in, and whether to sell or buy them.

Investment strategies are dynamic and may range from fixed on high-paying stocks to fixed on regular income from dividends. They are all designed to seek gain while managing risk. Learn more from suitable educators who are accessible via Mobic Edge. There are various investment strategies, and they are:

This method entails acquiring and holding an asset for a long period with blinders to market value. This method operates with the assumption that long-term investments are, hence, likely to expand with time.

This method involves investing a fixed amount of capital in a particular asset for a regular period (e.g., monthly or weekly). Investors disregard the asset price or market conditions at the time of each investment.

This strategy involves going against the crowd. These investors buy when other investors sell and sell when others buy.

This strategy involves investing in companies that may regularly pay dividends to owners of their shares. This method may be used primarily for those looking for a steady income stream. Learn more about investment strategies via Mobic Edge.

Investors need to understand how they could be taxed. This is because it may influence the overall gross of their investments. This knowledge, taught by firms Mobic Edge connects users to, may affect their decision-making process.

Momentum investing is observed to be the opposite of its contrarian counterpart as it depends majorly on market trends. They are usually for short-term investment opportunities. This may make this strategy suitable for investors looking for short-term gain rather than long-term goals.

The strategy is especially popular with people new to investing. It is a straightforward approach that involves selling off falling assets and buying rising ones. Learn more about momentum investing via Mobic Edge.

Investors use applications or resources to analyze, manage, and improve their investment decisions. These tools are important to investors because they may help track the portfolio's performance, assess risk, and conduct research. Acquire more knowledge on investment tools via Mobic Edge.

These are used to monitor how each investment performs across various accounts and asset classes.

These are used to assess the level of risk of investments or portfolios based on various factors like volatility. Examples of these include VAR calculators and risk assessment modules.

These provide insight into financial markets, including company reports, analyst ratings, and earning reports.

These are used to analyze price charts and patterns to make informed trading decisions. Register on Mobic Edge to learn more about these from investment tutors.

These are used to assess the financial health of investments through financial statements and ratios. Gain more insight into these via Mobic Edge.

They filter stocks based on specific criteria like price, volume, market cap, and financial ratio. Learn more about investment tools via Mobic Edge.

| 🤖 Joining Cost | No fees for registration |

| 💰 Operational Fees | No costs whatsoever |

| 📋 Registration Simplicity | Registration is quick and uncomplicated |

| 📊 Focus of Education | Lessons on Cryptocurrencies, Forex Trading, and Investments |

| 🌎 Countries Covered | Excludes the USA, covers most other countries |